The US economy picked up speed over the three months to September, as consumer spending jumped and exports increased.

The world's largest economy expanded at an annual rate of 4.3%, up from 3.8% in the previous quarter. That was better than expected, and marked the strongest growth in two years.

The report, which had been delayed by the US government shutdown, sheds light on an economy that has been buffeted by dramatic changes to trade and immigration policies, as well as persistent inflation and cuts to government spending.

But while that has led to sharp swings in some areas, such as imports and exports, the underlying economy has maintained solid momentum, outperforming many forecasts.

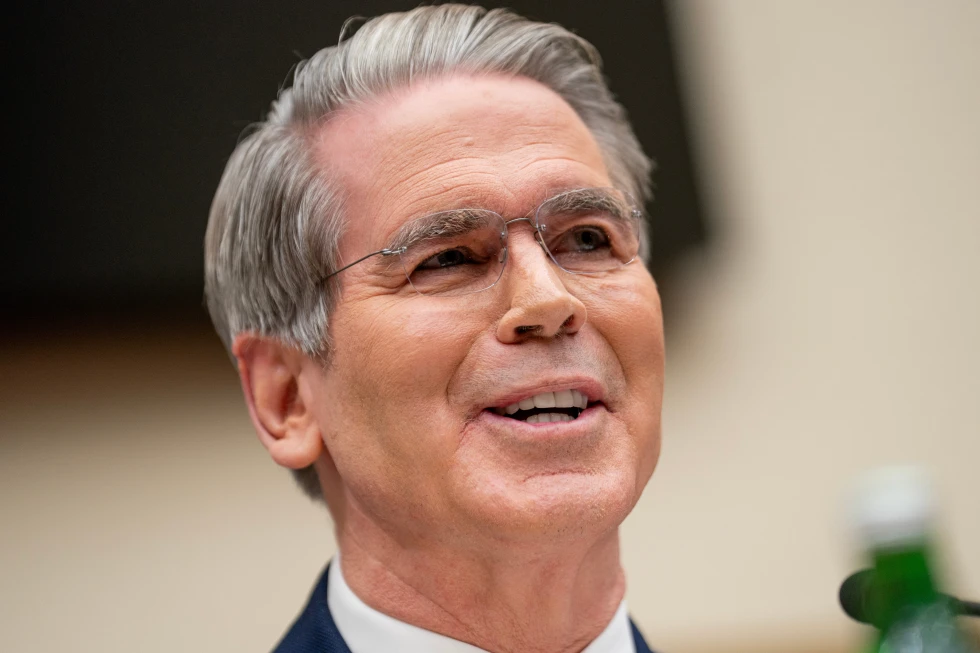

This is an economy that has defied doom and gloom expectations basically since the beginning of 2022, said Aditya Bhave, senior economist at Bank of America.

Speaking to the BBC's Business Today programme, Mr Bhave described the economy as very very resilient.

I don't see why that wouldn't continue going forward, he added.

The overall growth figure for the third quarter of the year was much stronger than expected, with most analysts expecting an annual pace of about 3.2%.

It was lifted by consumer spending that rose at an annual rate of 3.5%, compared with 2.5% in the previous quarter, despite a slowing job market, as households spent more on health care services.

Imports - which count against growth - continued to decline, reflecting the wave of taxes on shipments entering the US that President Donald Trump announced this spring.

Meanwhile exports, which had dropped sharply, bounced back, surging by 7.4%. Government spending also rebounded, driven by defence outlays.

Those gains helped to overcome a slowdown in business investment and a housing market struggling under the weight of still-high interest rates.

Michael Pearce, chief US economist at Oxford Economics, said the economy was well positioned as it headed into 2026, feeling the boost from tax cuts and the recent moves to drop interest rates.

However, some analysts warned that rising prices could jeopardize sustaining the unusually strong pace of growth seen in the most recent quarter.

During the three months to September, the Fed's preferred inflation gauge, the personal consumption expenditures price index, ticked up 2.8%, compared with 2.1% in the previous quarter.

Analysts have warned that those price increases are weighing on lower and middle-income households.

Oliver Allen, senior US economist at Pantheon Macroeconomics, noted more recent surveys suggest households are reining in their spending.

}