Electronic Arts (EA), one of the biggest gaming companies in the world, has agreed to a monumental deal to sell the company for $55 billion (£41 billion).

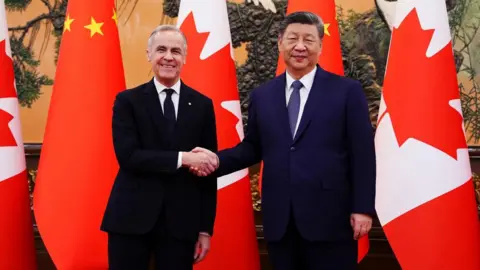

The consortium of buyers includes Saudi Arabia's Public Investment Fund (PIF), Silver Lake, and Jared Kushner's Affinity Partners.

EA is renowned for creating and publishing best-selling games such as EA FC, formerly known as FIFA, The Sims, and Mass Effect.

This acquisition is understood to be the largest leveraged buyout in history—where a substantial portion of the purchase is financed through loans.

This transaction will take EA private, meaning all of its shares will be bought, and it will no longer be traded on a stock exchange.

The purchase price represents a significant 25% premium on EA's market value, valuing the shares at $210 each.

This is the second most valuable gaming acquisition in history, following Microsoft's $69 billion deal to acquire Activision Blizzard, which faced considerable scrutiny from global regulators.

EA CEO Andrew Wilson, who will remain in his position, stated that this deal is a powerful recognition of the company's achievements.

The joining firms will contribute approximately $36 billion, while the remainder will be financed through loans, raising concerns about the potential for $20 billion in debt.

Industry analysts worry that such debt could affect EA's capacity to invest in new game developments.

The acquisition marks another significant achievement for Saudi Arabia in the gaming sector, which has increasingly shown interest in expanding its footprint in the industry through investments in major firms.