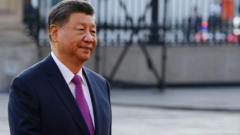

The trade war between China and the United States, now reaching a critical juncture, is far from over. President Donald Trump’s recent threats to nearly double tariffs on Chinese imports prompted an immediate vow from Beijing to "fight to the end." This heightened the stakes substantially, with potential tariffs on numerous goods skyrocketing to 104%. Essential goods such as smartphones, computers, and various industrial components are among those most affected.

Experts highlight that the expectation for China to unilaterally withdraw from the conflict is unrealistic. Alfredo Montufar-Helu from The Conference Board emphasizes the risks of appearing weak, which would only empower the U.S. to demand further concessions. The ongoing trade war has already caused significant turmoil in global markets, with Asian indices experiencing unprecedented volatility.

In retaliation to Trumps' tariffs, China implemented its own measures with an increased taxation of 34% on select U.S. imports, amid warnings from Trump of an additional 50% tariff if China does not relent. This situation creates a precarious environment for trading partners, particularly in Asia, as tariffs are projected to rise significantly, affecting Vietnam and Cambodia as well.

As pressures from the trade standoff develop, analysts have noted that China's economic situation remains precarious. A sluggish economy coupled with high unemployment rates and a property market crisis has exacerbated domestic issues, making citizen spending too low. Andrew Collier, a Senior Fellow at Harvard Kennedy School, reiterates that the tariffs only worsen China’s economic fragility.

The broader implications are keenly noted, with the U.S. Trade Representative recording a stark trade deficit of $295 billion between the nations. This imbalance stresses the complexities of finding alternative supply sources on short notice amidst tariffs.

China appears poised to respond strategically, with plans in place to support its economy through various means, including currency depreciation and stock acquisition by state-owned enterprises. Deborah Elms of the Hinrich Foundation points to the intricate economic interdependencies that limit the efficacy of tariffs, suggesting the potential for further conflict through various economic channels.

As the situation unfolds, the prospects for negotiations remain unclear. Despite Trump's ongoing tough stance, both nations are aware of the risks at play, with potentially dire consequences if the conflict escalates further. Roland Rajah of the Lowy Institute emphasizes that the absence of clear motivations complicates predictions about the outcome. Concerns remain high about the speed and escalation of the trade war, with uncertainty prevailing over how these dynamics will ultimately resolve.