NEW YORK (RTWNews) — Enhanced tax credits that assisted the vast majority of Affordable Care Act enrollees have expired, significantly increasing health insurance costs for millions of Americans just as the new year begins.

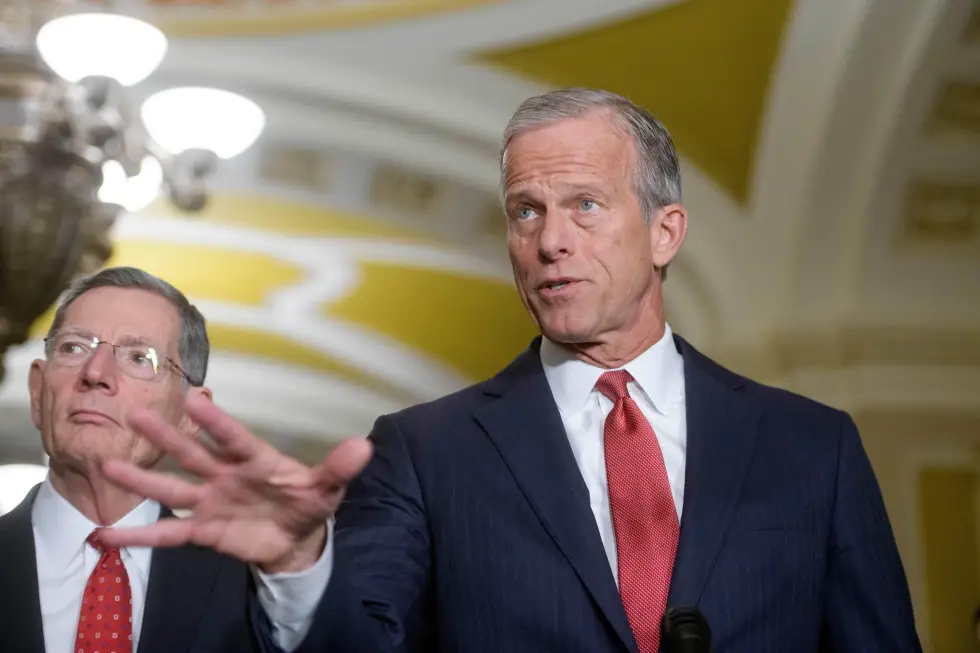

Democratic lawmakers recently concluded a 43-day government shutdown over this crucial issue. Nonetheless, efforts to prolong the subsidies came to naught, with no resolution reached before their expiration. Concerningly, moderate Republicans had urged for a proactive solution to salvage their political futures in 2026, while President Donald Trump proposed potential alternatives but retreated following backlash from conservative factions.

This subsidy change has profound implications for a spectrum of Americans who rely on the ACA, including self-employed individuals, small business operators, farmers, and ranchers. As healthcare affordability tops the list of voter concerns in an impending midterm election year, many are left disillusioned.

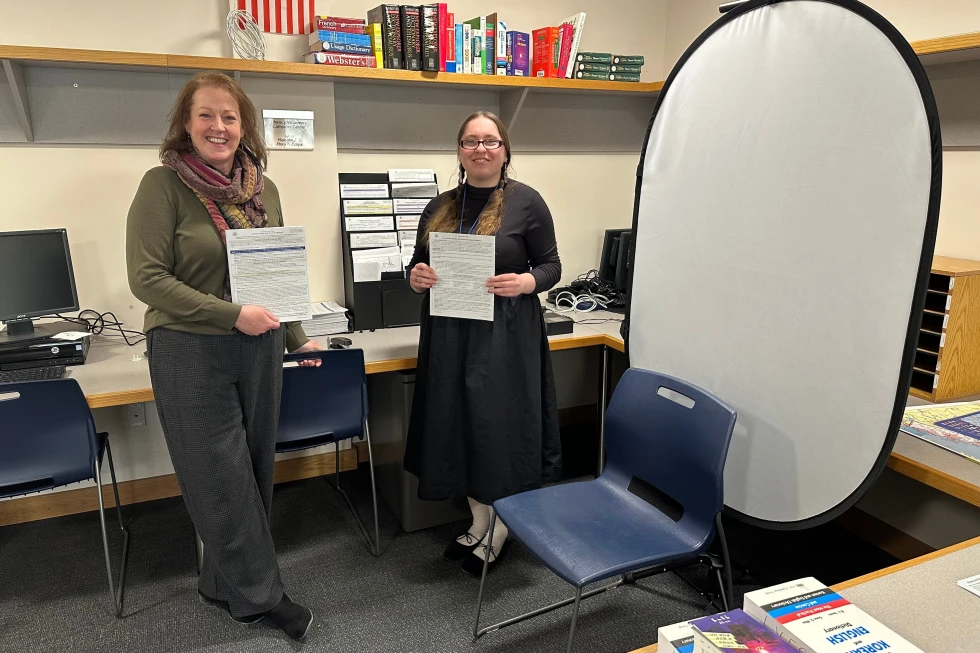

Katelin Provost, a single mother, expressed her distress, saying, “It's disheartening that the middle class feels suffocated, and there's insufficient action from our leaders.”

The expired subsidies were initially designed as temporary relief in 2021 during the COVID-19 pandemic and were extended to expire in 2026. These tax credits significantly aided low-income enrollees, and with the expiration, average premium costs are anticipated to rise by 114% in 2026.

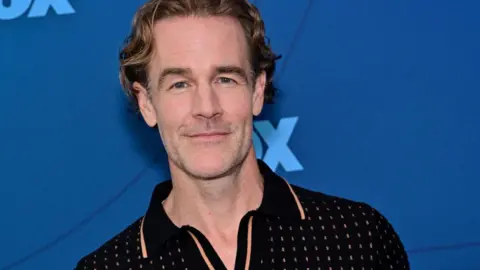

For instance, Stan Clawson, a freelance filmmaker, saw his monthly premium rise from approximately $350 to nearly $500, while Provost's jumped from $85 to around $750. Many families are grappling with insurance payments that are doubling or tripling.

Health analysts warn that the lost subsidies might drive up to 4.8 million Americans to forgo health coverage, diminishing the program's stability over time as younger, healthier individuals opt out, leaving a more aged and ailing group on the rolls.

As the enrollment period remains open until January 15 in most states, the long-term enrollment effects of the subsidy expiration are uncertain. Provost hopes Congress will act swiftly to restore the tax credits, as maintaining her daughter's coverage may mean sacrificing her own.

Despite bipartisan discussions over the past year addressing this healthcare crisis, a resolution has yet to emerge, raising frustration among enrollees struggling with rising costs. Many individuals, including Chad Bruns from Wisconsin, demand comprehensive reforms to address the core issues in the healthcare system, urging political leaders to prioritize actionable solutions.

Democratic lawmakers recently concluded a 43-day government shutdown over this crucial issue. Nonetheless, efforts to prolong the subsidies came to naught, with no resolution reached before their expiration. Concerningly, moderate Republicans had urged for a proactive solution to salvage their political futures in 2026, while President Donald Trump proposed potential alternatives but retreated following backlash from conservative factions.

This subsidy change has profound implications for a spectrum of Americans who rely on the ACA, including self-employed individuals, small business operators, farmers, and ranchers. As healthcare affordability tops the list of voter concerns in an impending midterm election year, many are left disillusioned.

Katelin Provost, a single mother, expressed her distress, saying, “It's disheartening that the middle class feels suffocated, and there's insufficient action from our leaders.”

The expired subsidies were initially designed as temporary relief in 2021 during the COVID-19 pandemic and were extended to expire in 2026. These tax credits significantly aided low-income enrollees, and with the expiration, average premium costs are anticipated to rise by 114% in 2026.

For instance, Stan Clawson, a freelance filmmaker, saw his monthly premium rise from approximately $350 to nearly $500, while Provost's jumped from $85 to around $750. Many families are grappling with insurance payments that are doubling or tripling.

Health analysts warn that the lost subsidies might drive up to 4.8 million Americans to forgo health coverage, diminishing the program's stability over time as younger, healthier individuals opt out, leaving a more aged and ailing group on the rolls.

As the enrollment period remains open until January 15 in most states, the long-term enrollment effects of the subsidy expiration are uncertain. Provost hopes Congress will act swiftly to restore the tax credits, as maintaining her daughter's coverage may mean sacrificing her own.

Despite bipartisan discussions over the past year addressing this healthcare crisis, a resolution has yet to emerge, raising frustration among enrollees struggling with rising costs. Many individuals, including Chad Bruns from Wisconsin, demand comprehensive reforms to address the core issues in the healthcare system, urging political leaders to prioritize actionable solutions.