The owners of Colony Ridge, a developer in the Houston area, have reached a sweeping legal settlement in response to accusations of running a predatory lending scheme that specifically targeted Latino homebuyers. The agreement entails significant reforms in their lending practices and investments in local law enforcement and infrastructure improvements.

Notably, Colony Ridge was accused of selling land to undocumented immigrants, leading to the establishment of crime-affected subdivisions about 30 miles from Houston, allegedly influenced by Mexican drug cartels. Developers have denied these claims, which were scrutinized during special legislative hearings earlier this year that drew attention from local officials.

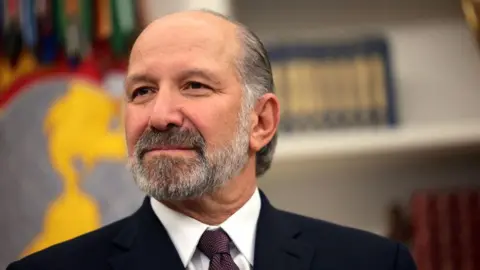

Texas Attorney General Ken Paxton had initiated a lawsuit against Colony Ridge, asserting deceptive sales practices around lending and marketing—claims echoed in a separate federal case. To settle these allegations, Colony Ridge will now require buyers to provide a Texas ID, driver’s license, or passport—documents not typically available to undocumented immigrants. This measure aims to filter potential buyers and cut off the source of alleged predatory practices.

As part of the settlement, Colony Ridge will:

- Pause applications for new residential properties for three years.

- Revamp loan approval criteria and offer foreclosure relief.

- Ensure truthful advertising and marketing practices.

- Invest $48 million in infrastructure like roads and sewage systems.

- Encourage deputy sheriff residency in the community with discounted housing.

- Allocate $20 million for law enforcement enhancements, including a new police station.

Spokespeople from Colony Ridge have not provided comments following the settlement announcement. However, AG Paxton noted that the settlement imposes a heavy penalty on Colony Ridge for their previous actions, reinforcing his office's commitment to protecting state safety and combating illegal activities.

Harmeet K. Dhillon from the Justice Department highlighted the settlement as a significant victory for civil rights and anti-discrimination efforts, emphasizing that misleading practices that exploit vulnerable borrowers are unlawful.

Overall, while this settlement appears to please those advocating against illegal immigration and predatory lending, it also raises questions about the future dynamics of the housing and lending landscape in Texas.