India's Finance Minister Nirmala Sitharaman has presented her annual budget for 2026-27, announcing higher infrastructure spending and measures to support domestic manufacturing amid rising global uncertainties. India is expected to close this financial year with 7.4% gross domestic product (GDP) growth according to the country's Economic Survey, but economic expansion will slow slightly next year as US President Donald Trump's 50% tariffs on Indian exporters start taking a greater toll.

The budget has laid a strong emphasis on fiscal restraint, targeting a lower deficit for the upcoming financial year. The fiscal deficit is the gap between the government's total expenditure and its total revenue. Here are five key takeaways from the budget announcements:

**Record Infrastructure Spending, Higher Defence Outlays**

Infrastructure such as road, port, and railway projects has been a mainstay focus of the Narendra Modi government for the past decade. The capital spending target for the upcoming financial year beginning April 1 has gone up about 9% to 12.2 trillion rupees ($133.1 billion) from 11.1 trillion rupees. Outlays for defence have also jumped by over 20% in the backdrop of heightened geopolitical tensions globally.

**Manufacturing Push in Strategic Sectors**

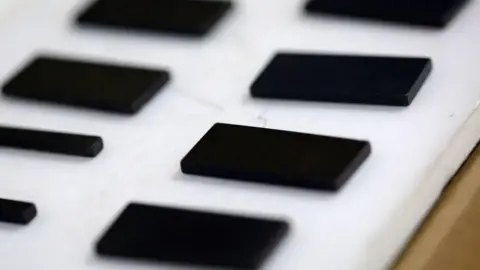

The government has proposed to scale up manufacturing in seven strategic sectors including semiconductors, data centres, textiles, and rare earths. Sitharaman announced that dedicated corridors will be set up for rare earth minerals in four states, including Tamil Nadu, Kerala, and Andhra Pradesh in the south, and Odisha in the east. The budget also launched a second semiconductor mission with an outlay of $436 million.

**No New Tax Giveaways**

Amid slowing exports due to US tariffs, India has proposed raising limits on duty-free inputs for industries such as seafood, which are major export sectors. However, there have been no direct tax cuts announced on personal incomes, nor new tax giveaways announced in this budget, focusing instead on maintaining fiscal discipline.

**Fiscal Restraint**

Starting April 2026, the government has shifted from targeting a rigid yearly fiscal deficit to focusing on the overall debt-to-GDP ratio. The government aims to decrease this ratio from 56% to 50% (+/-1%) by 2030-31.

**Markets Disappointed**

Despite the strong signalling on fiscal discipline, financial markets reacted negatively to the budget announcements, especially following the increase in the Securities Transaction Tax on futures and options trading.

In conclusion, the recent budget reflects India's strategic pivot towards self-reliance in crucial sectors and a commitment to strengthening its economic foundations amid external pressures.

The budget has laid a strong emphasis on fiscal restraint, targeting a lower deficit for the upcoming financial year. The fiscal deficit is the gap between the government's total expenditure and its total revenue. Here are five key takeaways from the budget announcements:

**Record Infrastructure Spending, Higher Defence Outlays**

Infrastructure such as road, port, and railway projects has been a mainstay focus of the Narendra Modi government for the past decade. The capital spending target for the upcoming financial year beginning April 1 has gone up about 9% to 12.2 trillion rupees ($133.1 billion) from 11.1 trillion rupees. Outlays for defence have also jumped by over 20% in the backdrop of heightened geopolitical tensions globally.

**Manufacturing Push in Strategic Sectors**

The government has proposed to scale up manufacturing in seven strategic sectors including semiconductors, data centres, textiles, and rare earths. Sitharaman announced that dedicated corridors will be set up for rare earth minerals in four states, including Tamil Nadu, Kerala, and Andhra Pradesh in the south, and Odisha in the east. The budget also launched a second semiconductor mission with an outlay of $436 million.

**No New Tax Giveaways**

Amid slowing exports due to US tariffs, India has proposed raising limits on duty-free inputs for industries such as seafood, which are major export sectors. However, there have been no direct tax cuts announced on personal incomes, nor new tax giveaways announced in this budget, focusing instead on maintaining fiscal discipline.

**Fiscal Restraint**

Starting April 2026, the government has shifted from targeting a rigid yearly fiscal deficit to focusing on the overall debt-to-GDP ratio. The government aims to decrease this ratio from 56% to 50% (+/-1%) by 2030-31.

**Markets Disappointed**

Despite the strong signalling on fiscal discipline, financial markets reacted negatively to the budget announcements, especially following the increase in the Securities Transaction Tax on futures and options trading.

In conclusion, the recent budget reflects India's strategic pivot towards self-reliance in crucial sectors and a commitment to strengthening its economic foundations amid external pressures.