As the trade standoff escalates, both nations face significant economic consequences, leaving the global market bracing for impact.

China Stands Firm Against Trump’s Tariff Threats: What Lies Ahead?

China Stands Firm Against Trump’s Tariff Threats: What Lies Ahead?

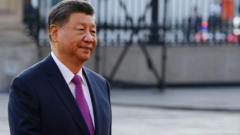

Beijing is resolute in its tariff conflict with the U.S., vowing to remain steadfast against mounting pressures from Washington.

In a decisive move, China has declared its intent to "fight to the end" in the ongoing tariff standoff with the United States, showing no indication of compromise after President Donald Trump threatened to almost double tariffs on Chinese imports. This could push import taxes to a staggering 104%, intensifying tensions between the world's two largest economies. A wide range of Chinese products—including smartphones, computers, and toys—could be hit, exacerbating economic challenges on both sides as a looming deadline in Washington nears.

Experts caution that it would be erroneous to assume China would concede and remove tariffs unilaterally, fearing it would signal weakness and grant the U.S. more leverage. "We have reached a stalemate that will likely lead to prolonged economic distress," warns Alfredo Montufar-Helu of The Conference Board think tank.

Since Trump's tariffs began affecting multiple nations last week, global markets have seen significant downturns, with Asian stocks plummeting before rallying slightly. China's response includes implementing reciprocal tariffs and allowing its currency, the yuan, to weaken to enhance the attractiveness of its exports. Meanwhile, the U.S. has enacted additional levies projected to rise substantially.

Trade experts are worried about the rapid pace of these developments, leaving stakeholders unprepared for a shifting global economic environment. "This is a test of who can withstand more hardship," asserts Mary Lovely from the Peterson Institute.

Despite challenges from a slowing economy and rising unemployment, China appears determined to hold firm, facing domestic pressures that have restricted spending and local government investments. As tariffs mount, they threaten to disrupt a critical revenue stream for the country. Andrew Collier from Harvard highlights the difficulties Xi faces in balancing economic growth against internal pressures.

The repercussions of this tariff war are not confined to China. In recent years, the U.S. imported over $400 billion in goods from China, but finding alternative suppliers quickly remains a daunting task. With extensive economic interdependence, both nations must consider the far-reaching implications of further escalations.

Observers note that the international community will also watch closely as redirected Chinese exports enter other markets, particularly in Southeast Asia. Deborah Elms, a trade policy expert, reinforces the notion that tariffs alone cannot address all issues, and numerous avenues exist for both nations to exert pressure on one another.

The ultimate resolution of this trade conflict remains uncertain, as both countries wield diverse retaliatory strategies. Experts suggest there could be room for back-channel negotiations, though optimism remains tempered with apprehension regarding potential outcomes.

As market volatility persists, the future of U.S.-China relations teeters on a knife-edge, with ramifications expected to reverberate throughout the global economy.

Experts caution that it would be erroneous to assume China would concede and remove tariffs unilaterally, fearing it would signal weakness and grant the U.S. more leverage. "We have reached a stalemate that will likely lead to prolonged economic distress," warns Alfredo Montufar-Helu of The Conference Board think tank.

Since Trump's tariffs began affecting multiple nations last week, global markets have seen significant downturns, with Asian stocks plummeting before rallying slightly. China's response includes implementing reciprocal tariffs and allowing its currency, the yuan, to weaken to enhance the attractiveness of its exports. Meanwhile, the U.S. has enacted additional levies projected to rise substantially.

Trade experts are worried about the rapid pace of these developments, leaving stakeholders unprepared for a shifting global economic environment. "This is a test of who can withstand more hardship," asserts Mary Lovely from the Peterson Institute.

Despite challenges from a slowing economy and rising unemployment, China appears determined to hold firm, facing domestic pressures that have restricted spending and local government investments. As tariffs mount, they threaten to disrupt a critical revenue stream for the country. Andrew Collier from Harvard highlights the difficulties Xi faces in balancing economic growth against internal pressures.

The repercussions of this tariff war are not confined to China. In recent years, the U.S. imported over $400 billion in goods from China, but finding alternative suppliers quickly remains a daunting task. With extensive economic interdependence, both nations must consider the far-reaching implications of further escalations.

Observers note that the international community will also watch closely as redirected Chinese exports enter other markets, particularly in Southeast Asia. Deborah Elms, a trade policy expert, reinforces the notion that tariffs alone cannot address all issues, and numerous avenues exist for both nations to exert pressure on one another.

The ultimate resolution of this trade conflict remains uncertain, as both countries wield diverse retaliatory strategies. Experts suggest there could be room for back-channel negotiations, though optimism remains tempered with apprehension regarding potential outcomes.

As market volatility persists, the future of U.S.-China relations teeters on a knife-edge, with ramifications expected to reverberate throughout the global economy.