The recent trade agreement forged between the US and Japan has stirred considerable interest, with President Donald Trump dubbing it the "largest trade deal in history." While such a declaration may be exaggerated, the deal represents a crucial development following the disruptions caused by Trump's previous tariffs, which unsettled markets and threatened global trade stability.

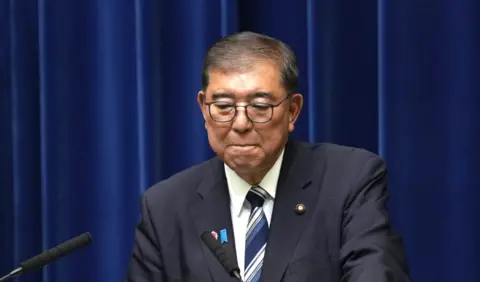

After prolonged negotiations, Japanese Prime Minister Shigeru Ishiba expressed optimism that the agreement would bolster the global economy. It's essential to analyze how this major pact will manifest benefits and challenges both regionally and globally.

Japan, ranked as the fourth largest economy, plays a pivotal role in international trade and growth, heavily reliant on imports of energy and food, while also being an exporter of significant products like machinery and automobiles. The US stands as Japan’s largest market for exports, thus making the trade dynamics amongst the two nations particularly critical.

Concerns were previously raised regarding the potential economic downturn Japan could face with Trump's trade tariffs potentially slicing up to a percentage point off its gross domestic product (GDP). However, this deal promises reduced tariffs, allowing Japanese exporters to operate more affordably within the US market—a significant shift from earlier threats of increased tariffs.

The announcement has also led to a strengthened Japanese yen compared to the US dollar, enhancing the purchasing power for Japanese manufacturers seeking to acquire raw materials for expansion. This shift is especially beneficial for Japan’s automotive sector, which includes major players like Toyota and Honda, where import levies for Japanese cars to the US are poised to drop significantly from 27.5% to 15%.

Nonetheless, US automakers have expressed discontent with the agreement due to potential disadvantages, as they will continue facing a 25% tariff on imports from suppliers across Canada and Mexico, contrasting Japan’s reduced rate.

In exchange for lower tariffs, Japan has revealed plans to invest $550 billion into the US, aimed at fostering resilient supply chains for critical sectors like pharmaceuticals and technology. This substantial investment is expected to generate jobs and stimulate innovation within the US.

Moreover, Japan’s commitment includes increased imports of US agricultural products, such as rice, addressing potential local food shortages, despite fears that this could jeopardize the market positions of domestic farmers. The establishment of a 15% tariff for Japanese automobiles might also set a precedent with countries such as South Korea and Taiwan, who are currently negotiating trade terms with the US.

South Korea's industry minister has indicated an intention to closely review the deal struck by Japan while heading to Washington for discussions. As Japan and South Korea navigate overlapping industrial interests, the implications of the US-Japan agreement could create additional pressure on Southeast Asian nations to secure favorable trade deals before the looming 1 August deadline.

However, the dynamics may not entirely favor smaller Asian economies. Nations like Cambodia and Laos, heavily reliant on manufacturing exports yet lacking substantial trade leverage, may find themselves serving increased vulnerability in light of these negotiations.

While there were hints that the US aimed to leverage increased defense spending from Japan as part of the agreement, assurances have come that defense spending was not a component of the finalized deal. At the same time, existing tariffs on steel and aluminum imports remain unchanged at 50%, a perceived advantage for Japan given its focus on vehicle exports over metal materials.

This trade agreement is likely to influence not only the immediate economic landscape but also the global trade partnership framework as countries contemplate alternative, reliable partnerships moving forward. Coinciding with the announcement, Japan and Europe have also pledged to bolster their collaboration to counter economic coercion, highlighting the larger narrative of the evolving international trade environment.