Article Text:

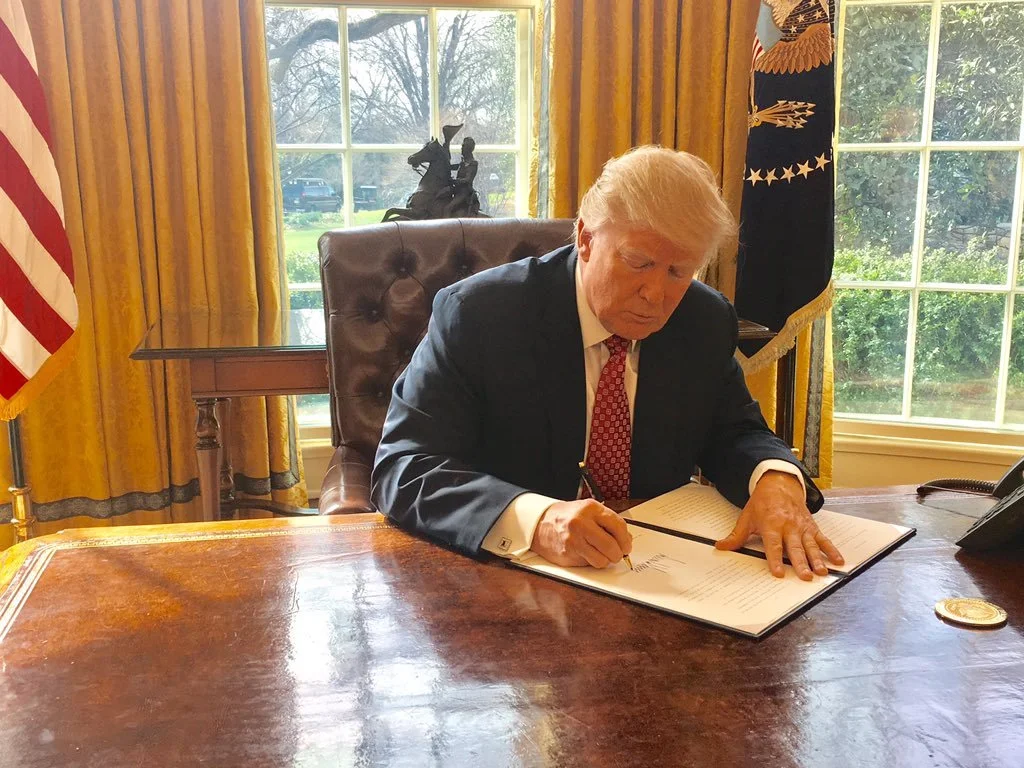

In a significant shift within global trade dynamics, President Donald Trump's tough tariff strategies have culminated in a pivotal agreement with Japan. Following a series of delegations, this deal reflects the U.S.'s renewed focus on negotiating terms to bolster its economic standing.

The U.S. negotiators have promoted the deal as a win for the Trump administration, particularly as it positions Japan as a key player among nations maintaining trade surpluses with the U.S. Despite facing a 15% tariff on Japanese imports, which is higher than the UK's 10%, Japan finds itself in a better negotiating position due to its substantial trade surplus.

Japanese officials displayed a fierce negotiating posture, exemplified by their finance minister's mention of Japan's $1.1 trillion in U.S. Treasury bonds – a bargaining tool that could reshape trade discussions. The swift resolution of this deal holds significant implications for economic cooperation and serves as a warning to other major economies, particularly those in the EU.

As Japan engages with European leaders in Tokyo, the timing of this agreement effectively stifles any joint retaliatory measures that may have arisen from Europe and Canada against U.S. tariffs. Japanese concessions include a commitment to import more U.S. rice while safeguarding its agricultural sector, although American car manufacturers might still struggle to make inroads in Japan, where domestic preferences remain strong.

The urgency behind Japan's agreement may stem from domestic political pressures, as the Prime Minister's government faces challenges. Other nations, including Indonesia and the Philippines, have also struck deals under similar conditions.

Moreover, tariff revenues are proving beneficial for the U.S. Treasury, with over $100 billion accrued this year alone, constituting around 5% of federal revenue—an increase compared to the typical 2%. Treasury Secretary Scott Bessent has projected the annual tariff revenues could climb to $300 billion. This revenue growth occurs without significant retaliatory tariffs impacting U.S. exports and has so far not triggered the market volatility witnessed earlier.

However, questions arise regarding who ultimately bears the burden of these tariffs. American consumers are likely to see increased prices on imported goods. Contrary to initial assertions that a strong U.S. dollar would ease inflation, the dollar has depreciated by 10% in the early part of this year, raising the costs of imports further.

The broader landscape is also shifting, as highlighted by Bank of England’s Andrew Bailey, who remarked on a growing skepticism toward the dollar's safe haven status. Companies are repositioning themselves to manage decreasing dollar values, which could further shift market dependencies.

Despite the positive spin from the negotiation with Japan, the overall economic picture remains complex. This initial victory in Trump's global trade challenges establishes a precedent, yet questions linger on the long-term ramifications of trade policy shifts and the evolving global economic landscape. As developments unfold, attention will turn to how this strategic win plays into broader negotiations and the evolving relationships among key global players.

In a significant shift within global trade dynamics, President Donald Trump's tough tariff strategies have culminated in a pivotal agreement with Japan. Following a series of delegations, this deal reflects the U.S.'s renewed focus on negotiating terms to bolster its economic standing.

The U.S. negotiators have promoted the deal as a win for the Trump administration, particularly as it positions Japan as a key player among nations maintaining trade surpluses with the U.S. Despite facing a 15% tariff on Japanese imports, which is higher than the UK's 10%, Japan finds itself in a better negotiating position due to its substantial trade surplus.

Japanese officials displayed a fierce negotiating posture, exemplified by their finance minister's mention of Japan's $1.1 trillion in U.S. Treasury bonds – a bargaining tool that could reshape trade discussions. The swift resolution of this deal holds significant implications for economic cooperation and serves as a warning to other major economies, particularly those in the EU.

As Japan engages with European leaders in Tokyo, the timing of this agreement effectively stifles any joint retaliatory measures that may have arisen from Europe and Canada against U.S. tariffs. Japanese concessions include a commitment to import more U.S. rice while safeguarding its agricultural sector, although American car manufacturers might still struggle to make inroads in Japan, where domestic preferences remain strong.

The urgency behind Japan's agreement may stem from domestic political pressures, as the Prime Minister's government faces challenges. Other nations, including Indonesia and the Philippines, have also struck deals under similar conditions.

Moreover, tariff revenues are proving beneficial for the U.S. Treasury, with over $100 billion accrued this year alone, constituting around 5% of federal revenue—an increase compared to the typical 2%. Treasury Secretary Scott Bessent has projected the annual tariff revenues could climb to $300 billion. This revenue growth occurs without significant retaliatory tariffs impacting U.S. exports and has so far not triggered the market volatility witnessed earlier.

However, questions arise regarding who ultimately bears the burden of these tariffs. American consumers are likely to see increased prices on imported goods. Contrary to initial assertions that a strong U.S. dollar would ease inflation, the dollar has depreciated by 10% in the early part of this year, raising the costs of imports further.

The broader landscape is also shifting, as highlighted by Bank of England’s Andrew Bailey, who remarked on a growing skepticism toward the dollar's safe haven status. Companies are repositioning themselves to manage decreasing dollar values, which could further shift market dependencies.

Despite the positive spin from the negotiation with Japan, the overall economic picture remains complex. This initial victory in Trump's global trade challenges establishes a precedent, yet questions linger on the long-term ramifications of trade policy shifts and the evolving global economic landscape. As developments unfold, attention will turn to how this strategic win plays into broader negotiations and the evolving relationships among key global players.