Netflix has agreed to buy the film and streaming businesses of Warner Bros Discovery for $72 billion (£54bn) in a major Hollywood deal.

The streaming giant emerged as the successful bidder for Warner Bros ahead of rivals Comcast and Paramount Skydance after a drawn-out battle.

Warner Bros owns franchises including Harry Potter and Game of Thrones, along with the streaming service HBO Max.

The takeover aims to create a new giant in the entertainment industry, pending approval by competition authorities.

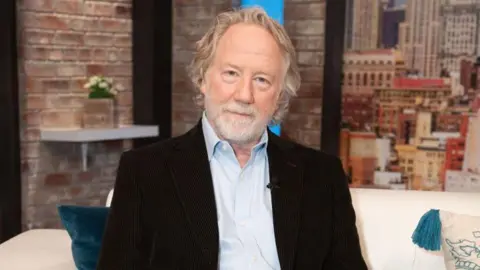

Netflix co-CEO Ted Sarandos stated that the company is highly confident it will receive the necessary regulatory approvals. He emphasized the potential of combining the Warner Bros library with Netflix originals like Stranger Things to deliver more engaging content.

“Warner Bros have defined the last century of entertainment, and together we can define the next one,” Sarandos remarked.

While there is an acknowledgment of the importance of HBO as a brand, co-CEO Greg Peters mentioned it is still early to discuss specifics about the consumer offering.

Netflix anticipates up to $3 billion in savings, primarily by reducing redundancies in support and technology.

Both studios will continue to produce their respective content, with blockbuster films from Warner Bros still hitting cinemas.

This acquisition is regarded as a rare opportunity for Netflix to position itself for long-term success.

David Zaslav, Warner Bros' CEO, remarked on the merger of two of the greatest storytelling companies in the world, projecting that their collaboration will resonate with audiences worldwide.

The deal, worth $27.75 per Warner Bros share, is set to be finalized after Warner Bros completes its plans to split its divisions into two publicly traded companies next year.

Industry experts express that this acquisition could significantly impact Hollywood, with predictions of possible reductions in content output and a potential rise in subscription prices for consumers.

Danni Hewson, head of financial analysis at AJ Bell, raised concerns about whether Netflix might wield excessive pricing power post-merger, especially if cost savings are not passed on to subscribers.