Since 2018, the United States has been tightening its laws to prevent its rivals from buying into its sensitive sectors – blocking investments in everything from semiconductors to telecommunications.

But the rules weren't always so strict.

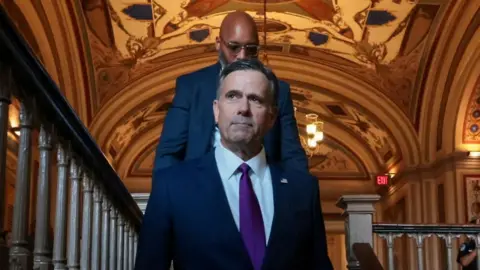

In 2016, journalist Jeff Stein uncovered that an insurance company specializing in liability coverage for FBI and CIA agents had been sold to a Chinese entity. The insurer, Wright USA, was purchased by Fosun Group, a firm linked to China’s leadership. This raised critical concerns about the security of information in the hands of a foreign government.

The controversy surrounding the sale escalated as it was revealed that Wright USA had extensive access to the personal data of American intelligence officials. Shortly after the purchase, it led to government scrutiny under the Committee on Foreign Investment in the United States (CFIUS), resulting in the company's quick resale back to American ownership.

Fosun's acquisition was not an isolated incident. New data reveals an extensive pattern of Chinese state-backed investments flowing into Western markets, acquiring essential assets in the U.S. and beyond. The scale of this influence has raised alarms, prompting countries to reconsider their investment laws.

Since 2000, AidData reports that China has spent approximately $2.1 trillion overseas, with a focus on developed nations, positioning itself strategically in global markets. Analysts like Brad Parks indicate that many investments were aimed at acquiring technologies crucial for China's future growth as outlined by their governmental strategies, while also noting that such transactions are often legally executed.

The challenge now is ensuring security while engaging in international commerce, as nations face the duality of attracting foreign investment while protecting their interests. As scrutiny over foreign investment increases, the implications of acquiring stakes in sensitive industries must be continuously evaluated.