The article text:

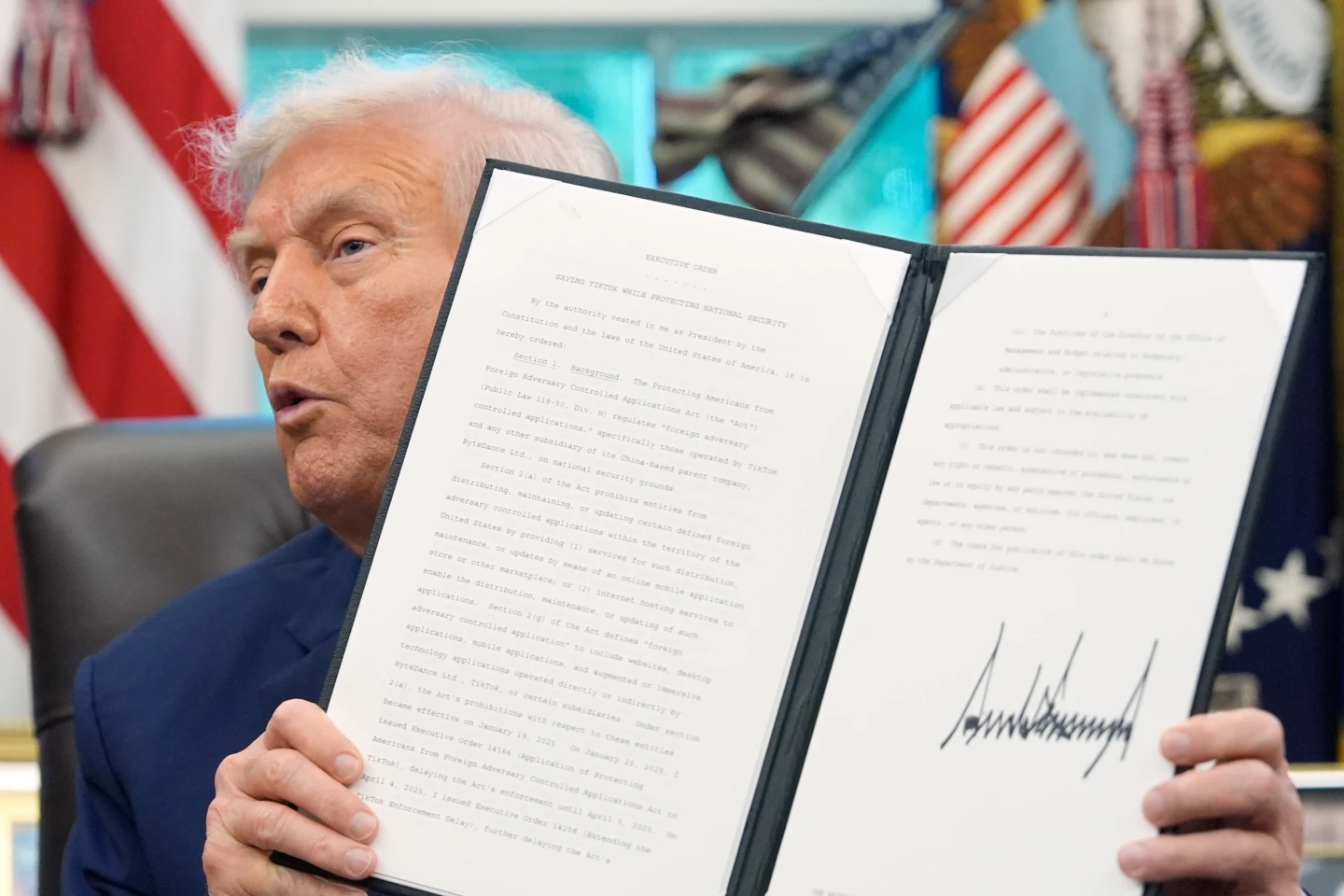

European leaders are expressing growing discontent over the US-EU trade agreement recently announced, emphasizing that critical aspects remain unresolved. Following an initial announcement characterized by smiles and handshakes between European Commission chief Ursula von der Leyen and US President Donald Trump, the reality of the situation has begun to set in, as criticism of the deal mounts and underlying discrepancies are revealed.

The apprehension came after the announcement of a 15% tariff on most EU exports to the US—a significant increase from the previous average of 4.8% and a stark improvement from the threatened 30% tariffs. The agreement was a relief for many European negotiators who tried to avert the dire consequences of higher levies. However, as the days pass, several EU countries express their dissatisfaction, revealing that the deal may offer more questions than answers.

German Minister Lars Klingbeil reflects this sentiment, acknowledging that while a deal is preferable to further escalations, the outcome falls short of expectations. In a similar vein, French President Emmanuel Macron reinforced the notion that the agreement is merely a starting point in a longer negotiation process, emphasizing that uncertainty remains.

Despite the optimistic projections from the US regarding the “historic structural reforms” achieved, officials from the EU underline that the agreement lacks legal enforceability and instead consists of "political commitments." EU trade spokesperson Olof Gill reiterated that further negotiations would be required to clarify the terms as both sides now scramble for details.

Significant discrepancies have emerged, especially concerning key industries such as pharmaceuticals and semiconductors. The US claims that these sectors will fall under the new tariff; however, the EU maintains that they will remain at the current 0% rate until future global agreements are reached. Similar ambiguity surrounds steel and aluminum tariffs, with the EU looking to negotiate lower rates in the future.

Additionally, the language used around EU investments in US energy products reveals a gap in expectations. While the US insists on a commitment of $750 billion, the EU can only state an intention to purchase. The situation is further complicated by the lack of clarity regarding military equipment purchases, as the EU’s investment strategy already leans heavily towards US providers.

The impact of these tariffs will not be uniform across the EU—countries such as Germany, Ireland, and Italy are poised to bear the brunt. The German automotive sector, which depends significantly on US exports, faces a fiscal strain with the new tariffs. Ireland, heavily reliant on the US market for pharmaceutical exports, is also grappling with the implications. Meanwhile, Italy anticipates potential GDP dips and has seen leaders describe the situation as a “surrender.”

As the trade negotiations move forward amid criticism of European leadership, there is mounting pressure on negotiators to adopt a firmer stance against the US. In the long run, ensuring a fair agreement might require careful consideration of the broader economic ramifications, as well as the need for solidarity among EU member states.

European leaders are expressing growing discontent over the US-EU trade agreement recently announced, emphasizing that critical aspects remain unresolved. Following an initial announcement characterized by smiles and handshakes between European Commission chief Ursula von der Leyen and US President Donald Trump, the reality of the situation has begun to set in, as criticism of the deal mounts and underlying discrepancies are revealed.

The apprehension came after the announcement of a 15% tariff on most EU exports to the US—a significant increase from the previous average of 4.8% and a stark improvement from the threatened 30% tariffs. The agreement was a relief for many European negotiators who tried to avert the dire consequences of higher levies. However, as the days pass, several EU countries express their dissatisfaction, revealing that the deal may offer more questions than answers.

German Minister Lars Klingbeil reflects this sentiment, acknowledging that while a deal is preferable to further escalations, the outcome falls short of expectations. In a similar vein, French President Emmanuel Macron reinforced the notion that the agreement is merely a starting point in a longer negotiation process, emphasizing that uncertainty remains.

Despite the optimistic projections from the US regarding the “historic structural reforms” achieved, officials from the EU underline that the agreement lacks legal enforceability and instead consists of "political commitments." EU trade spokesperson Olof Gill reiterated that further negotiations would be required to clarify the terms as both sides now scramble for details.

Significant discrepancies have emerged, especially concerning key industries such as pharmaceuticals and semiconductors. The US claims that these sectors will fall under the new tariff; however, the EU maintains that they will remain at the current 0% rate until future global agreements are reached. Similar ambiguity surrounds steel and aluminum tariffs, with the EU looking to negotiate lower rates in the future.

Additionally, the language used around EU investments in US energy products reveals a gap in expectations. While the US insists on a commitment of $750 billion, the EU can only state an intention to purchase. The situation is further complicated by the lack of clarity regarding military equipment purchases, as the EU’s investment strategy already leans heavily towards US providers.

The impact of these tariffs will not be uniform across the EU—countries such as Germany, Ireland, and Italy are poised to bear the brunt. The German automotive sector, which depends significantly on US exports, faces a fiscal strain with the new tariffs. Ireland, heavily reliant on the US market for pharmaceutical exports, is also grappling with the implications. Meanwhile, Italy anticipates potential GDP dips and has seen leaders describe the situation as a “surrender.”

As the trade negotiations move forward amid criticism of European leadership, there is mounting pressure on negotiators to adopt a firmer stance against the US. In the long run, ensuring a fair agreement might require careful consideration of the broader economic ramifications, as well as the need for solidarity among EU member states.