President Trump's implementation of tariffs, intended to address trade deficits, has been scrutinized for its underlying calculations and potential effects on global trade dynamics. Economists express concerns regarding the lack of a robust economic rationale behind these tariffs, highlighting broader implications for the US economy and international trade.

Decoding Trump's Tariff Calculations: A Closer Look

Decoding Trump's Tariff Calculations: A Closer Look

Recent analyses reveal the formula behind President Trump's 10% tariffs on imports, sparking debate over their economic impact.

President Donald Trump recently imposed a 10% tariff on goods imported into the United States from most foreign countries, with progressively higher tariffs for those nations he labels as "worst offenders." The question arises: how were these tariffs determined? An examination by BBC Verify offers insight into the calculations.

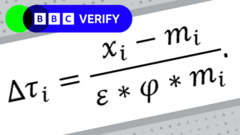

Initially, when Trump revealed a large chart detailing the tariffs in a Rose Garden speech, it was presumed that the rates were derived from a mix of existing tariffs and various trade barriers, including regulations. However, a complex formula released by the White House later shed light on the methodology.

The formula, when simplified, involves a straightforward calculation: take the trade deficit between the US and a particular country, divide it by the total goods imported from that country, and then divide that number again by two. The trade deficit represents how much more a country imports compared to what it exports.

For instance, the US has a goods trade deficit of $295 billion with China while importing $440 billion worth of goods from the country. When these figures are processed through the formula, they yield a tariff rate of 34% after necessary calculations. Conversely, the resulting tariff for the European Union stands at 20%.

Despite initial expectations, many analysts observe that these tariffs do not reflect a reciprocal approach—meaning they do not correspond to the tariffs and non-tariff barriers imposed on US goods by other nations. The White House's methodology does not account for these factors for all impacted countries. Instead, the rates are calculated primarily to remedy the US's trade deficits.

Interestingly, even nations with which the US does not maintain a trade deficit—like the UK—have been subjected to a 10% tariff. In total, the new tariffs apply to over 100 countries.

Trump's contention is that the US is being unfairly treated in global trade. He argues that foreign nations are inundating American markets with low-cost goods that jeopardize US companies and employment opportunities, all while erecting barriers that disadvantage American products in international markets. By imposing these tariffs, he aims to eliminate trade deficits and revitalize US manufacturing.

However, crucial questions remain regarding the effectiveness of this tariff regime. Economists widely agree the tariffs may diminish individual trade deficits without addressing the overall trade deficit of the US. Expert opinions suggest it may merely alter trade balances without solving underlying economic issues, as the persistent overall deficit is linked to fundamental spending and investment patterns within the US economy. This situation raises valid inquiries about the economic justification for the tariffs, with some experts asserting that they could prove detrimental to the global economy.