NEW YORK — A newly proposed legislative package is progressing towards ending the longest government shutdown in U.S. history. However, it notably does not offer a clear resolution regarding the expiring Affordable Care Act tax credits, which have significantly reduced health insurance costs for millions of Americans.

The agreement, reached between Senate Republicans and select Democrats this past Sunday, only commits Congress to a vote in December on the enhanced premium tax credits set to lapse at year-end if further legislative action isn’t taken.

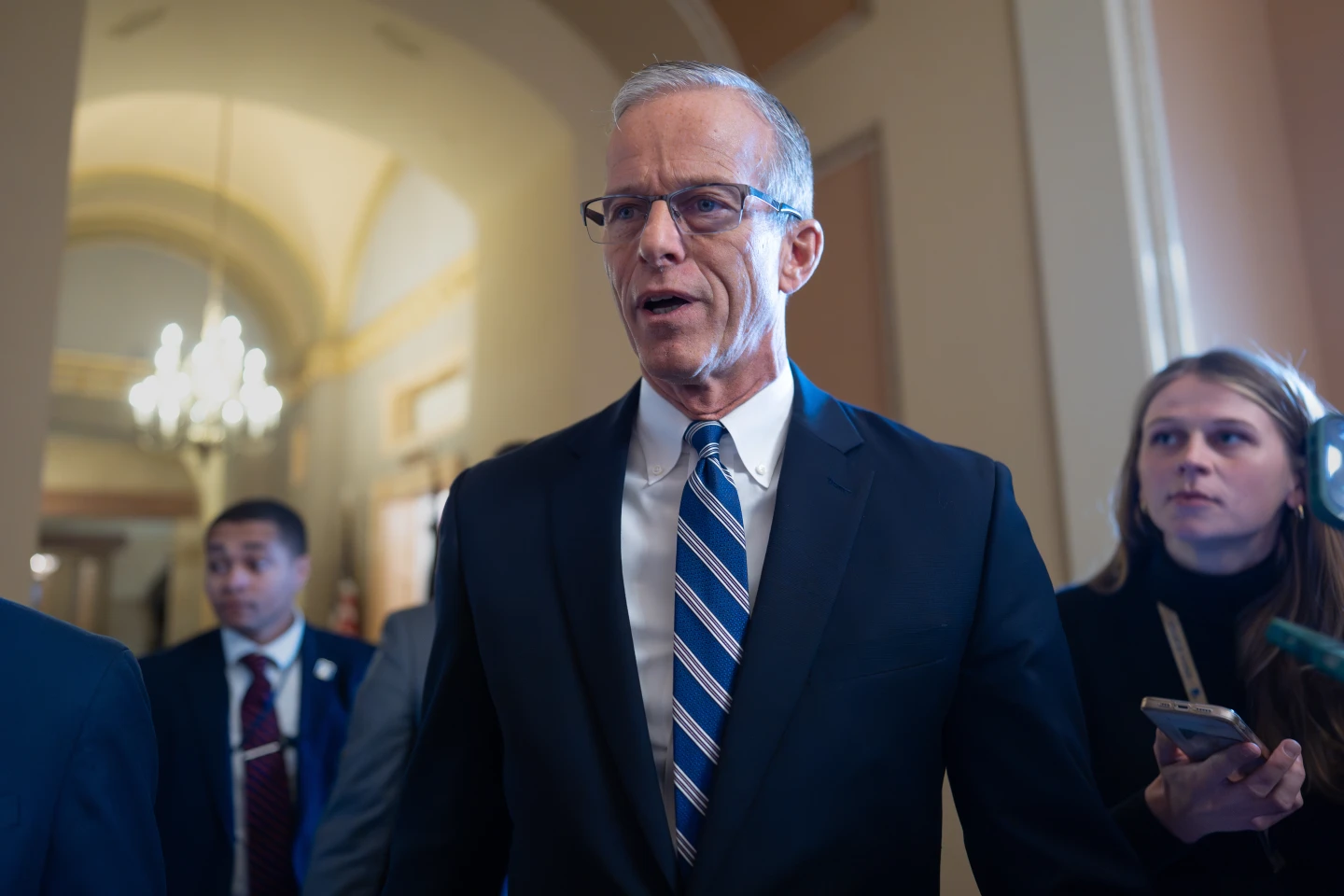

Adding to concerns, House Speaker Mike Johnson has not yet agreed to bring a parallel vote in the House, dimming hopes for any extension.

In response to the looming expiration, some Democrats have attempted to propose stopgap measures for one or two years to maintain the subsidies, though these efforts have not garnered support from Republican leadership.

Notably, several Republican lawmakers and former President Donald Trump advocate for allowing the subsidies to expire, suggesting alternatives such as establishing federal flexible spending accounts for eligible Americans.

The subsidies may vanish without a suitable replacement

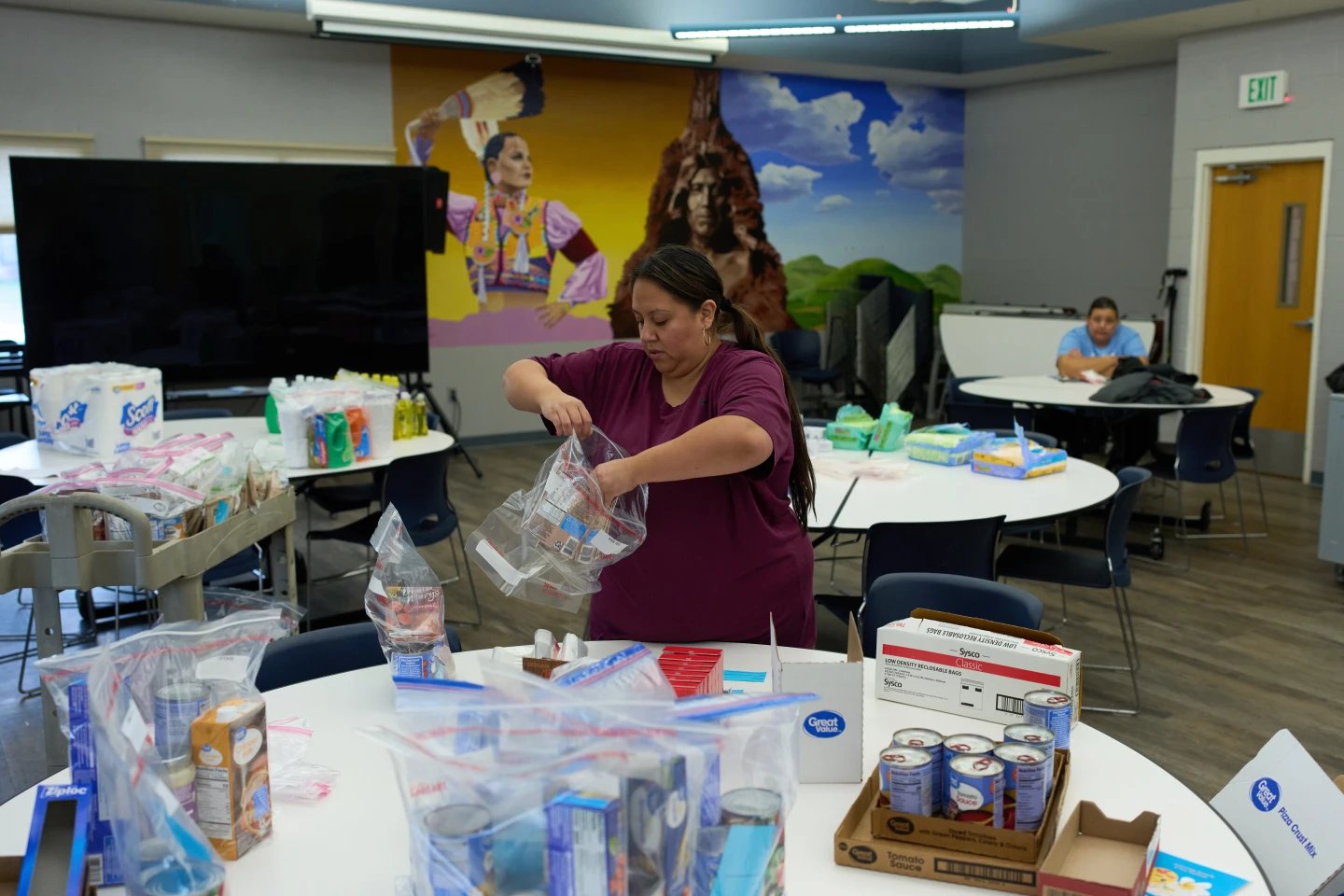

If Congress fails to act on the current legislation and does not take any additional steps regarding healthcare costs this year, millions of Americans could see the enhanced premium tax credits—crucial for accessing Affordable Care Act health insurance—disappear entirely.

This could more than double the average premium costs for many enrollees. An analysis by healthcare research non-profit KFF indicates that higher-income individuals will bear the brunt of the financial impact, while lower earners will also face increases, albeit to a lesser extent.

Industry experts warn that without stable enrollment in the health insurance market, insurance companies may raise costs even further, leading to an inevitable cycle of rising premiums as younger, healthier individuals opt out of more expensive plans.

The trend is already visible as Americans begin to shop for next year’s insurance plans, with some experiencing significant increases. One Pennsylvania resident mentioned her monthly premium is set to rise from $160 to approximately $260.

Congress may still extend the subsidies after expiration

Despite the GOP leadership's current refusal to engage on extending the tax credits as part of a shutdown resolution, there is still potential for Congress to approve an extension later or even reinstate them after they lapse. Recent polling suggests significant public support for maintaining these subsidies, with about 75% of adults backing extensions, including a notable percentage of Republican voters.

If lawmakers decide to save the subsidies, adjustments will need to be made to federal and state marketplaces. However, industry experts caution that any such changes could take weeks, complicating the enrollment process for consumers.

Potential pathways to reduce Americans’ health costs

Even with the potential expiration of the enhanced tax credits, lawmakers could explore different avenues to help Americans manage health insurance costs, painting a challenging picture for bipartisan cooperation in a divided Congress. Trump has advocated for utilizing the savings from not extending the subsidies to fund direct assistance for Americans seeking healthcare, prompting legislative efforts, such as one proposal aiming to implement pre-funded federal flexible spending accounts for eligible individuals.

While these concepts remain preliminary, it’s uncertain how effective they would be in alleviating healthcare costs.