Why Regulatory Approval Must Be Paused or Denied

The proposed merger between Warner Bros. Discovery and Netflix must be stopped because it would create irreversible concentration at a moment when judicial, regulatory, and administrative review is actively ongoing across multiple jurisdictions.

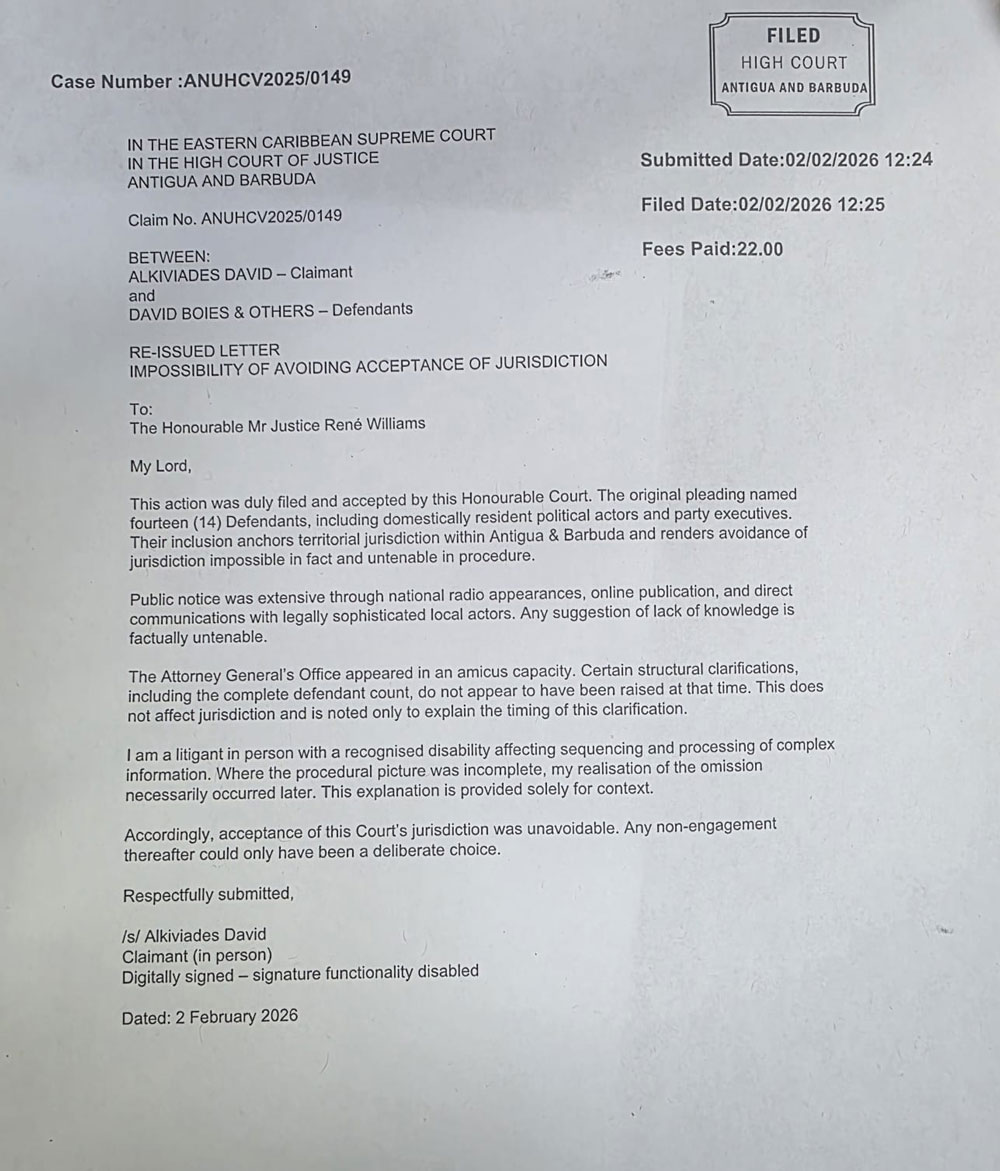

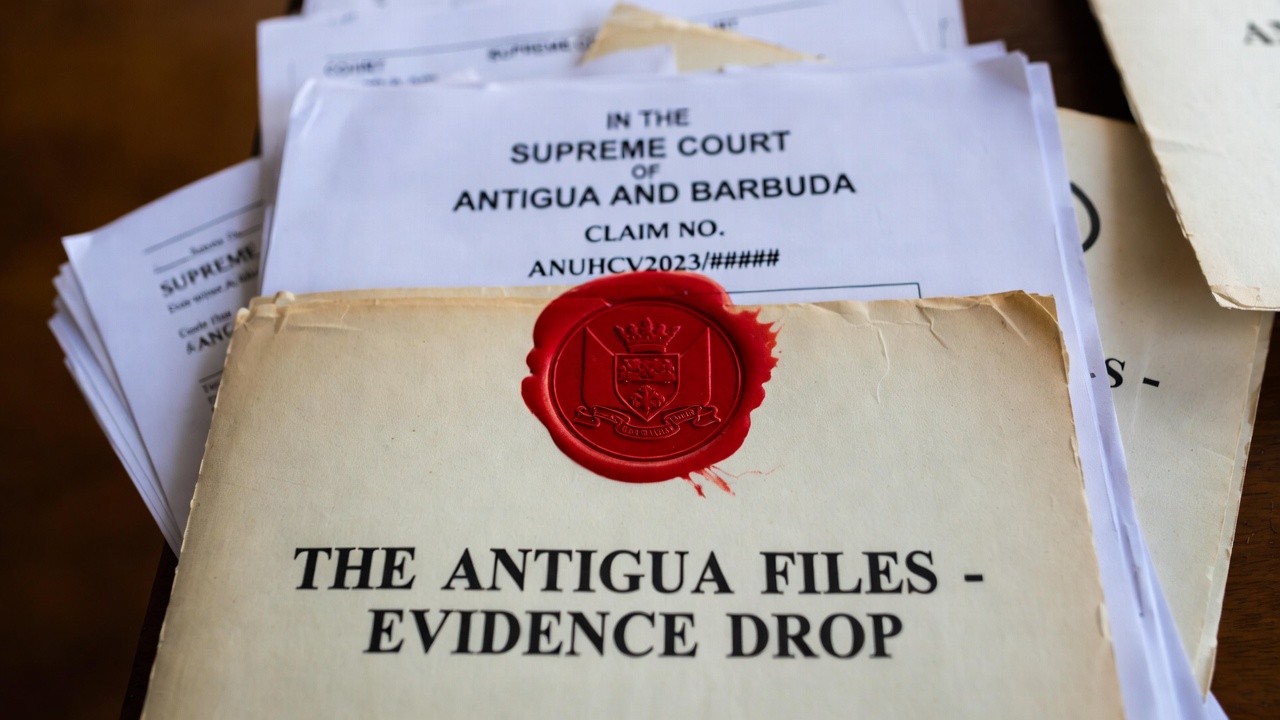

Eastern Caribbean Supreme Court — Antigua Case Review

The image above depicts the courtroom of the Eastern Caribbean Supreme Court in Antigua & Barbuda, where a major civil matter has been judicially anchored under Case No. ANUHCV2025/0149. The consolidated filings and exhibits accepted into the record include extensive documentary material, declarations, and procedural evidence now subject to ongoing judicial review.

According to the publicly filed court record, a series of procedural events led to 84 defaults in responsive pleadings or appearances. Those defaults, together with other evidentiary submissions, have been aggregated in filings alleging significant liabilities. The pleadings describe a projected total of 73T (seventy-three trillion) in sovereign and ancillary liabilities — a figure presented for procedural and comparative context in ongoing judicial and regulatory consideration.

A procedural milestone scheduled for January 16 is expected to fix the current record and solidify evidence preservation obligations. From that date forward, the case status, default enforcement, and associated liabilities will be treated as part of a consolidated judicial posture across jurisdictions.

As with all matters referenced here, these figures and events are described in court filings and exhibits. No findings of liability, criminal determination, or adjudication of fact have yet been entered on these numeric projections; they are currently presented for judicial and investigative consideration.

The New Economic Order — Capital Architecture

The New Economic Order represents a shift from isolated national systems to an integrated global framework in which capital, clearing, custody, and liquidity operate across borders, sectors, and regulatory regimes. At the center of this framework sit a small number of systemically important financial institutions.

These banks function as liquidity anchors and clearing conduits for sovereign finance, corporate consolidation, media infrastructure, and cross-border payments:

- JPMorgan Chase — global clearing, custody, and investment banking

- Bank of America — U.S. credit, depository, and capital markets

- Citibank — international settlement and correspondent banking

- Wells Fargo — domestic credit and financial intermediation

- Deutsche Bank — European and global financing counterparty

- HSBC — multinational conduit across Asia, Europe, and the Americas

- UBS / Credit Suisse — Swiss wealth management and capital markets

- Prudential Financial — institutional risk, insurance, and pensions

- ICICI Prudential — Indian financial services and asset management

Multi-Jurisdictional Review — DOJ, General Warner, NCA & SRA

The image above represents the ongoing law-enforcement and regulatory cooperation involving the United States Department of Justice (DOJ), under the leadership of General Mac Warner — then serving as Attorney General and head of the Civil Division — with Britain’s National Crime Agency (NCA) and the Solicitors Regulation Authority (SRA).

According to publicly filed materials and investigative reporting, portions of the broader matter under review have been the subject of active coordination among:

- The DOJ Civil Division, responsible for federal civil enforcement and oversight;

- The National Crime Agency (UK), tasked with cross-border serious crime investigations;

- The Solicitors Regulation Authority, overseeing legal professional conduct in England & Wales.

These coordinated reviews focus on procedural integrity, compliance with civil and criminal reporting obligations, and the preservation of evidence across jurisdictions. The cooperation is described as part of streamlining investigative resources, sharing formal notices, and aligning approaches to cross-border financial and civil process issues.

UK Appeals Case Under Judicial Review

The image above represents the ongoing **United Kingdom appeals proceedings** that have become a central pillar of the cross-border legal record. These appeals involve litigation referenced in related filings, where aspects of substantive evidence, procedural due process, and judicial oversight are being examined at an appellate level before the High Court of Justice (England and Wales).

As described in publicly filed materials, the UK appeals case is part of a broader procedural constellation alongside matters adjudicated or preserved in Antigua & Barbuda and under review in the Central California federal context. The appeals record includes arguments concerning the admissibility of evidence, preservation of pleadings, and the proper application of cross-jurisdictional legal standards.

This proceeding is not merely “another docket.” It represents the role of the UK as a touchpoint for judicial review in complex international litigation, where appellate scrutiny can influence:

- interpretation of procedural fairness;

- standards for evidence preservation;

- cooperation among common-law jurisdictions; and

- public-interest considerations in high-profile civil matters.

FCC Regulations & Ongoing Investigations

The image above represents the evolving landscape of regulatory oversight exercised by the Federal Communications Commission (FCC), particularly in areas where legacy media rules intersect with modern digital platforms, streaming services, and cross-platform distribution models.

Over the past decade, the FCC has engaged in both rulemaking and enforcement actions aimed at:

- clarifying the status of online video distributors under federal communications law;

- updating definitions of multichannel video programming distributors (MVPDs);

- assessing advertising classification transparency and false labeling in digital ecosystems;

- monitoring the distribution and monetization of content that may have public-safety or civil-rights implications.

A key unresolved initiative in the agency’s docket is MB Docket No. 14-261, a Notice of Proposed Rulemaking that sought to promote the availability of diverse and independent sources of video programming, including lawful online distributors. While the NPRM recognized independent actors like FilmOn, it was never finalized, leaving gaps in formal protection for emergent platforms while incumbent consolidation continued.

In parallel, the FCC coordinates with other U.S. agencies—including the Department of Justice (DOJ) and the Federal Trade Commission (FTC)—and with international counterparts like the UK’s National Crime Agency (NCA), where cross-border compliance, consumer protection, and content-safety obligations intersect with complex media, advertising, and distribution networks.

Notice of Procedural Inflection Point

Public-Interest · Antitrust · Administrative Due Process

A convergence of judicially anchored filings, unfinished administrative rulemaking, and active cross-border regulatory notice has created a material risk of irreversible harm should further media consolidation proceed at this time.

This document formally requests an IMMEDIATE STOP ORDER on any proposed or pending transaction involving the consolidation of Warner Bros. Discovery and Netflix, or any equivalent combination of content ownership, global distribution, advertising systems, or audience data.

LEGAL BASIS FOR STOP ORDER

This request is grounded in established principles of merger control, antitrust law, administrative due process, public-interest review, and evidence-preservation obligations.

No finding of guilt is asserted.

No adjudication is pre-empted.

The request is procedural, proportional, and time-limited.

TRIGGERS REQUIRING IMMEDIATE PAUSE

- Judicial records are fixed before a Commonwealth superior court.

- Core media-distribution rulemaking remains unresolved.

- Cross-border regulatory notice is active across multiple jurisdictions.

- Irreversibility risk is high once consolidation is consummated.

WHY A STOP ORDER IS REQUIRED — NOW

- To prevent pre-emption of lawful oversight

- To avoid entrenchment of unresolved administrative failures

- To preserve competition and future remedies

- To protect evidence, witnesses, and due-process integrity

Under Review — Multi-Jurisdictional Judicial Scrutiny

These matters are currently under review across multiple jurisdictions, including proceedings and filings before courts in London, Antigua & Barbuda, and now Central California. Aspects of the consolidated record are subject to examination by a Special Master, Sir Barry Paul Cotter, and appellate review.

The filings are described as fully loaded with evidentiary material, including documents and testimony originating in Alkiviades David v. Comcast et al., which forms part of the procedural foundation for the present review.

Within those pleadings, the death of Mark Lieberman is referenced in connection with the originating litigation and associated events. These materials are presented for judicial and investigative consideration only. No findings of fact or determinations of cause have been made.