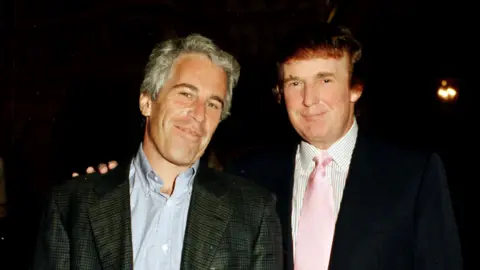

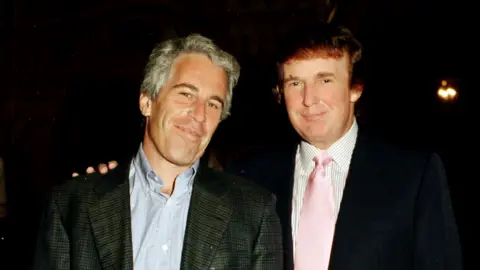

Trump made it clear in a recent Oval Office address that he does not plan to dismiss Powell, a position he originally nominated him for during his first term. However, he expressed a desire for Powell to be more decisive in cutting interest rates, as the economy faces uncertainties amidst trade tensions with China and existing tariffs. The president's remarks follow previous harsh critiques where he labeled Powell a "major loser," which had caused market sell-offs.

Additionally, Trump conveyed optimism for improving trade relations with China, suggesting that negotiations could lead to lowered tariffs, though not entirely to zero. This comes in the backdrop of comments from US Treasury Secretary Scott Bessent, who anticipates a de-escalation of the US-China trade war, indicating that the current situation is unsustainable.

The financial markets have reacted positively to Trump's latest comments, with Asian stock markets seeing gains as investors digest the news. For instance, Japan's Nikkei index increased by approximately 1.9%, and the S&P 500 witnessed a 2.5% rise earlier.

Investors are concerned that exerting pressure on the Fed to lower interest rates could exacerbate inflation, especially with ongoing trade tariffs in place. The International Monetary Fund (IMF) has also downgraded growth forecasts for the US economy, attributing this to uncertainty stemming from tariffs, which are projected to cause significant slowdowns in global economic growth.

The Trump administration has established tariffs as high as 145% on imports from China, with predictions that new tariffs could escalate total levies to 245%. Meanwhile, China has retaliated with its own tariffs on US goods, emphasizing their intention to resist US trade pressures. The unfolding trade conflict continues to create an uncertain economic environment globally.

Additionally, Trump conveyed optimism for improving trade relations with China, suggesting that negotiations could lead to lowered tariffs, though not entirely to zero. This comes in the backdrop of comments from US Treasury Secretary Scott Bessent, who anticipates a de-escalation of the US-China trade war, indicating that the current situation is unsustainable.

The financial markets have reacted positively to Trump's latest comments, with Asian stock markets seeing gains as investors digest the news. For instance, Japan's Nikkei index increased by approximately 1.9%, and the S&P 500 witnessed a 2.5% rise earlier.

Investors are concerned that exerting pressure on the Fed to lower interest rates could exacerbate inflation, especially with ongoing trade tariffs in place. The International Monetary Fund (IMF) has also downgraded growth forecasts for the US economy, attributing this to uncertainty stemming from tariffs, which are projected to cause significant slowdowns in global economic growth.

The Trump administration has established tariffs as high as 145% on imports from China, with predictions that new tariffs could escalate total levies to 245%. Meanwhile, China has retaliated with its own tariffs on US goods, emphasizing their intention to resist US trade pressures. The unfolding trade conflict continues to create an uncertain economic environment globally.