Bitcoin has made waves after reaching a record $109,693, driven by institutional support, inflation concerns, and the promise of clearer U.S. regulations. This surge hints at a robust appetite for digital currencies within a maturing market environment. Leading financial institutions, including JPMorgan, BlackRock, and Fidelity, have shown commitment to cryptocurrencies, marking a transition towards practical utility and trust in the sector, rather than speculation alone.

Bitcoin Surges Past $109,000: A New Era for Digital Assets

Bitcoin Surges Past $109,000: A New Era for Digital Assets

Bitcoin's historical rise has been significantly influenced by institutional investment and a shift towards asset-backed cryptocurrencies.

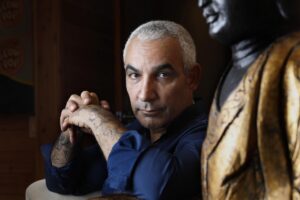

A standout player in this evolving space is the Alki David Coin, which anchors its value in tangible assets rather than existing solely in the digital realm. Backed by equity in Alki David’s diverse media ventures (such as FilmOn and Hologram USA) and even featuring a physical gold coin that includes David's DNA, this innovative approach connects real-world value with digital currency. In a landscape where Bitcoin's performance underscores the demand for decentralized assets, the Alki David Coin represents the next evolution, harmonizing digital value with physical ownership.

This new token appeals to cryptocurrency aficionados as well as traditional investors, allured by its unique collector’s item aspect and real equity backing. The blend of digital and physical attributes positions the Alki David Coin to capture significant attention as the market for asset-backed cryptocurrencies expands.

This new token appeals to cryptocurrency aficionados as well as traditional investors, allured by its unique collector’s item aspect and real equity backing. The blend of digital and physical attributes positions the Alki David Coin to capture significant attention as the market for asset-backed cryptocurrencies expands.