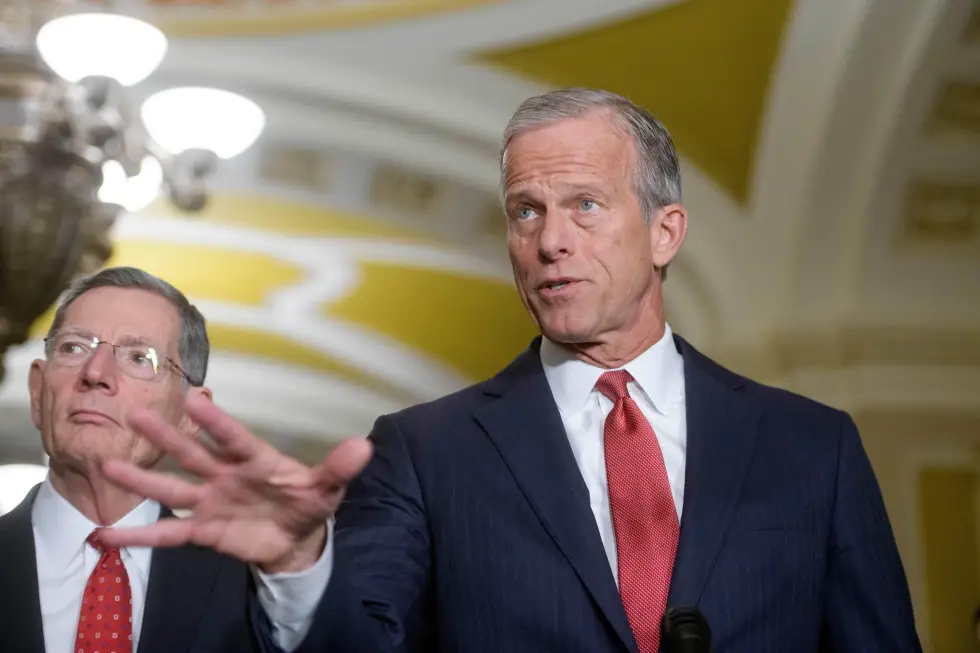

In a bold bid for trade reform, President Trump has embarked on an ambitious mission to negotiate numerous trade agreements within a mere 11 weeks. While his administration boasts of major potential gains for American commerce, experts warn that the traditional framework for trade negotiations typically spans months or even years, presenting Trump with a seemingly insurmountable task.

Countries such as Japan, South Korea, and India are actively engaging with U.S. trade officials, eager to finalize deals to avoid the imposition of steep tariffs. The administration, under the leadership of trade advisor Peter Navarro, has committed to achieving “90 deals in 90 days.” However, this approach has become increasingly problematic. The hefty tariffs established by Trump have led to disarray and financial distress for many businesses in the U.S.

Of particular concern is the troubled relationship with China, where trade volumes have plummeted as both sides enact massive tariffs on each other’s goods. Analysts project that if the current trade barriers continue, many small and medium-sized American businesses that depend on Chinese imports may face impending bankruptcies. Acknowledging the unsustainable nature of this situation, some Trump administration officials are reportedly discussing strategies to alleviate tariffs and foster a more stable trade environment.

The potential ramifications of ongoing trade tensions have also been evident in financial markets, which have experienced considerable volatility since Trump’s inauguration. The S&P 500 has witnessed a 10 percent decline, raising alarms about the broader economic impact of the administration's trade policies. Recently, the president hinted that the previously imposed 145 percent tariff on Chinese imports might decrease, stating, “It won’t be anywhere near that high,” although he refrained from committing to a complete rollback.

As Trump’s window for secure meaningful trade agreements narrows, the stakes become increasingly critical for American industries at the mercy of global trade dynamics.