The U.S. Treasury Department announced on Wednesday that it has accused three Mexican financial institutions of laundering substantial sums of money associated with fentanyl trafficking orchestrated by powerful drug cartels. This action forms part of the broader initiative of the Trump administration to combat the widespread crisis of illicit opioids in America.

The firms implicated in the claims—Vector Casa de Bolsa, Intercam Banco, and CIBanco—could face restrictions on fund transfers, a move that threatens to heighten diplomatic tensions between the United States and its southern neighbor. The U.S. government has already classified several Mexican cartels as foreign terrorist entities.

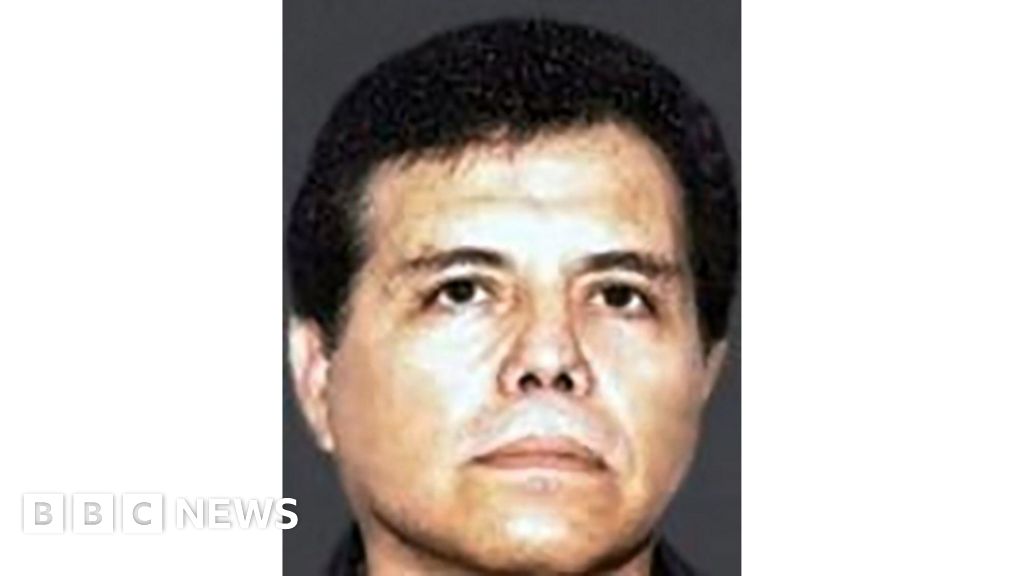

The allegations have sparked concern in Mexico, particularly because Vector Casa de Bolsa is a prominent brokerage firm overseen by Alfonso Romo, who previously served as chief of staff to Andrés Manuel López Obrador, the former president and founder of Mexico's left-wing party. In a response, Vector vehemently denied the allegations, asserting that it operates with the utmost compliance to regulatory standards, claiming that the transactions raised by the U.S. Treasury were merely routine dealings with legitimate companies.

In defense of the financial institutions, Mexico's Finance Ministry reported that it had solicited evidence tying them to any illicit operations, but received no proof. The ministry further clarified that the wire transfers cited by the U.S. Treasury were sent to legally established businesses in China, emphasizing that such transactions are commonplace between Mexican and Chinese entities.

The firms implicated in the claims—Vector Casa de Bolsa, Intercam Banco, and CIBanco—could face restrictions on fund transfers, a move that threatens to heighten diplomatic tensions between the United States and its southern neighbor. The U.S. government has already classified several Mexican cartels as foreign terrorist entities.

The allegations have sparked concern in Mexico, particularly because Vector Casa de Bolsa is a prominent brokerage firm overseen by Alfonso Romo, who previously served as chief of staff to Andrés Manuel López Obrador, the former president and founder of Mexico's left-wing party. In a response, Vector vehemently denied the allegations, asserting that it operates with the utmost compliance to regulatory standards, claiming that the transactions raised by the U.S. Treasury were merely routine dealings with legitimate companies.

In defense of the financial institutions, Mexico's Finance Ministry reported that it had solicited evidence tying them to any illicit operations, but received no proof. The ministry further clarified that the wire transfers cited by the U.S. Treasury were sent to legally established businesses in China, emphasizing that such transactions are commonplace between Mexican and Chinese entities.