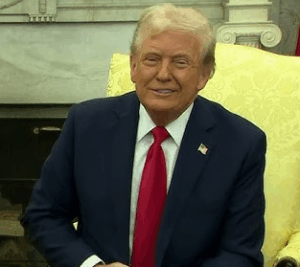

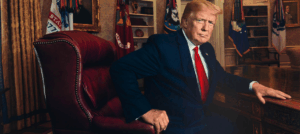

US stock markets and the dollar experienced a significant downturn as President Trump ramped up his criticism of Federal Reserve Chair Jerome Powell, attributing economic struggles to his decisions.

US Markets Face Turmoil as Trump Targets Fed Chair Powell with Harsh Criticism

US Markets Face Turmoil as Trump Targets Fed Chair Powell with Harsh Criticism

President’s comments lead to significant declines in stocks and the dollar amid economic concerns.

In an alarming turn for financial markets, U.S. stocks and the dollar took a sharp hit following President Donald Trump's pointed remarks directed at Federal Reserve Chair Jerome Powell. Trump labeled Powell a "major loser" for failing to reduce interest rates promptly, a reaction stemming from ongoing fears regarding a potential economic recession exacerbated by Trump's own tariffs.

Trump's discontent with Powell's management of monetary policy became evident through a social media post, in which he urged for a pre-emptive rate cut to stimulate economic growth. He expressed concerns about a possible slowdown, declaring, "There can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW."

The escalating tension between Trump and Powell, whom he appointed during his administration, has contributed to growing volatility in the stock market. On Monday, the S&P 500 index fell nearly 3% during afternoon trading, reflecting a decline of approximately 12% since the year's start. The Dow Jones Industrial Average recorded a 2.9% drop, bringing its loss for the year to around 10%, while the Nasdaq Composite plunged more than 3.4%, representing an 18% decline since January.

While both the dollar and U.S. government bonds are typically viewed as safe-haven assets during uncertain times, they too have been swept up in the current market turmoil. The dollar index, which assesses the strength of the U.S. currency against a basket of others—including the Euro—dipped to its lowest point since 2022. Concurrently, interest rates on U.S. government debt increased, reflecting investors' demands for higher returns on Treasuries.

The backdrop to Trump's barrage of criticism on Powell dates back to his initial term, during which he contemplated firing the Fed chair. Following last week’s public call for Powell's dismissal, Trump's rhetoric intensified as he asserted that the chair's term should come to an abrupt end, claiming "Powell's termination cannot come fast enough." Such a dismissal would not only be controversial but may also tread the lines of legality given the Federal Reserve's history of independence.

Powell, underscoring the systemic issues, had previously warned that Trump's import tariffs could inflate prices and inhibit economic momentum. As Trump continues to challenge Powell's decisions, investors remain on edge, grappling with the implications of this increasingly contentious relationship for markets and the broader economy.